9 Beauty eCommerce Trends That Will Define the Industry In 2022

INTRODUCTION

The beauty sector has always been at the forefront regarding online retail innovation and reinvention. Beauty brands continuously seek to improve their client experience, from clean beauty to hyper-personalized skincare and A.I. cosmetics solutions.

The beauty sector is undergoing rapid change, so we thought we’d look at the top beauty eCommerce trends we expect to see in the following years.

1. INFLUENCERS ARE AN INVESTMENT

For the last several years, influencer marketing has been an integral aspect of beauty eCommerce tactics. It was determined that for every dollar invested in influencer marketing, firms had a return on investment of roughly $11.45, according to the British Beauty Council’s 2020 Value of Beauty study.

A return on investment in such marketing resources has finally been established in the beauty business and its advertising channels due to the emergence of influencers and micro-influencers (influencers with tiny follower counts, generally 100,000 or less).

Influencer marketing expenditure increased from $2 billion in 2017 to around $8 billion in 2019, according to Harvard Business School, and that spending is predicted to rise to $15 billion by 2022.

Estée Lauder, a cosmetics giant, currently spends 75% of its marketing budget on influencers, while L’Oréal contributes 30% of its media budget to digital platforms, reinforcing these results.

Many influencers provided

YouTube videos and articles for L’Oréal’s website and social channels,

their media,

resulting in a combined influencer reach of 5.5 million people.

After working as a beauty influencer, Michelle Phan saw how much clients liked watching videos of individuals opening new cosmetic products and exhibiting new looks. To help customers understand how to utilize the goods in their Ipsy bags, Ipsy has enlisted the help of beauty influencers and brand advocates.

They share their millions in YouTube ad revenue with Ipsy, which they then return to the company by making these beauty influencers a cornerstone of their business, offering services to help emerging influencers connect with Ipsy’s vast audience, and creating a plush studio where influencers can create videos with high production values.

However, there may be a new trend in the influencer industry: According to the statistics, “authenticity-displaying beauty brands and influencers will stand out in this competitive industry,” Mintel projected in the future. Furthermore, being more upfront and honest with your followers might help them gain confidence.

Alessia Vettese, an MBA student at Harvard Business School, performed a research that backs up their statements. According to Vettese’s research, 43 percent of women who identify as “beauty enthusiasts” stated they would only buy products from influencers who publicly declare their sponsorships.

Another interesting note is that customers, according to Vettese, seek influencers with similar skin tones and sensitivity to their own, as well as assurances that the influencers sincerely believe in and utilize the items they promote. Because of these new values of openness and relatability, consumers commonly think they can form a personal connection with micro-influencers, paving the way for the rise of equally influential micro-influencers.

2. BRAND PARTNERSHIPS

Collaborating with other businesses is up to “30 times cheaper than digital advertising,” according to market research by AdNews. This is particularly true in the cosmetics sector, where a flurry of social media postings and product evaluations translate anticipation into actual purchases whenever a new makeup partnership is announced. As a result of their popularity, these goods are sometimes regarded as treasures by their target demographic (like Andy Warhol x NARS).

Source: The Beauty Rebel

Even individuals who aren’t interested in cosmetics may benefit from a marketing strategy known as co-branding when they blend their favorite childhood snacks or television shows with makeup and beauty interests to expand their consumer base.

Both Cheetos and Hershey made full use of this business strategy. The recently introduced Cheetos-themed eyeshadow and bronzer palettes and a XXTRA Flamin’ Hot lip gloss set sparked excitement among customers.

Etude House collaborated with the Hershey Corporation to manufacture chocolate bar-themed items in January. Both palettes have packaging inspired by Hershey’s Creamy Milk Chocolate bar packaging and Cookies’ N’ Creme bar packaging. Since it was a “collector’s item” because of its unique product and package design, the brand rapidly became a bestseller. In addition, Morphe, an eyeshadow company, has collaborated with brands, including Coca-Cola. Innisfree, a Korean beauty brand, has launched a new Mentos-themed product line.

(Source: Etude House)

Therefore, large corporations aren’t the only ones taking advantage of this opportunity: Using influencers as co-branding partners is a novel and successful strategy to unite two distinct groups of consumers and generate interest, sales, and brand loyalty in the increasingly complex world of digital advertising.

Colourpop collaborated with several high-profile YouTubers, like Kathleenlights, with over four million followers. Only via social media did the makeup brand get its start, and it has since grown to such a cult following that it is now available at Sephora and Ulta stores.

A growing number of new firms are using the ready-to-use audiences that influencers have created in the digital and collaborative environment.

(Source: Colourpop)

3. HYPER-PERSONALIZED SKINCARE

It was discovered that 80 percent of respondents in an Epsilon online poll of 1,000 18-64-year-olds considered personalization attractive, and 90 percent said they were more inclined to conduct business with a firm that offered tailored experiences.

Hyper-personalization in the beauty e-commerce has grown owing to A.I. technology and two-way, data-driven communication between companies and customers.

Numerous instances have emerged since the fourth quarter of 2019: Using a selfie, Neutrogena developed MaskiD, a 3D-printed face mask personalized to your skin’s requirements. In addition to La Roche-My Posay’s Skin Track pH patch, which analyzes pH levels and prescribes treatments through an app on your phone, SkinCeuticals showcased custom-made Custom Dose correction serums tailored to each individual’s skin type.

Meanwhile, Mintel Research reported that in 2019, Google searches for “microbiome” (the microorganisms on and within your body) surged by +110 percent year-on-year 2019. There has been an increase in searches for “hyper-personalized” face skincare products. Some of the world’s most famous beauty brands, including Johnson & Johnson, have already established a specialized microbiome platform.

Hyper-personalization is a means for firms to stand out in the highly competitive beauty eCommerce sector by enabling customers to make educated selections based on their tastes rather than drowning them with unlimited possibilities. Brand loyalty and repeat sales may be achieved by using technology to help consumers satisfy their requirements.

Customers of Prose complete a 25-question online survey to establish the optimal bespoke formulas and product regimens based on their answers. From hair type and scalp issues to environmental and lifestyle factors, 135 data points may be accessed by the organization.

In addition, to address the issue of British men struggling to find the right cosmetics and personal care products, Geologie was born: a subscription service that provides men a customized routine based on questions about race and region, among other things.

Therefore, consumers are more eager than ever to discuss with their preferred brand if they believe their desires will be listened to and modified in a data-driven environment.

4. INCLUSIVITY

Nielsen performed a poll that found that the beauty aisles in the United States are finally starting to represent the variety of the American population. Seven times the number of distinct color ranges have been created, and three times more unique colors have been sold in foundations than in any other kind of product category.

When purchasing items, consumers are looking for value-driven options that represent their individuality and lifestyles. According to statistics from the Global Cosmetic Industry, there has been an increase in the sales of multicultural beauty goods that is twice as fast as that of the traditional market.

(Source: Common Thread)

While Too Faced, a company is known for its inventive cosmetics and diverse product lines, reported a $350 million annual revenue. Illamasqua, with the motto “Express your originality,” said a profit of $50 million, and both companies saw their yearly revenue climb sharply in 2017.

Black Opal Beauty generated $15 million in sales by identifying the absence of undertones in the market. As Black Opal’s V.P. of Sales and Marketing, Derek Wanner, explains: “Ethnic clients not only have beauty aspirations, but they also had buying power that was being wasted by a beauty industry that did not cater to the diversity of skin tones and undertones.”

Despite the promising beginning, Black and Ethnic Minority women think that lines with a wide variety of shades create additional problems: quantity over quality. Because firms aren’t addressing the undertones as effectively as they should, which implies they’re missing out on opportunities.

Kimberly Smith, the co-founder of Brown Beauty Co-Op: “If you’re someone of color and you see a company with 50 colors and not take into account the diverse undertones and all of the other things.” It turns out that more than just skin tone or hue is at play here. Taking the effort to find out precisely what we need in our cosmetics is, in my view, a disservice to the companies who serve us.

5. A.I. TECHNOLOGY

Virtual try-on technology developed by the world’s premier AR business, Perfect Corp, was incorporated into Jack Ma’s Alibaba group’s Taobao and Tmall online shopping experiences a few years ago. Thanks to this, consumers in China now have additional options for virtual try-outs. Perfect Corp’s A.R. technology achieved a 4x improvement in conversion rate in only six months for Alibaba.

(Source: A.I. Business)

MAC and NARS are just a few companies that have incorporated A.I., AR, and V.R. into their products since then. Even L’Oreal CEO established a global purpose for the brand to transform from a beauty to a beauty technology company.

Moreover, using deep learning and computer vision, Nutox and Ministry X.R. have created a “skin analysis tool” for Malaysian consumers to help them purchase skincare products, a step that avoids difficulty not having access to samples in-store.

(Source: Ministry X.R.)

Anyone with a smartphone may use the application “to examine their skin and detect significant skin issues such as wrinkles, hyperpigmentation, texture, and dullness,” according to the company website.

Nutox was able to better connect with their customers, increase the perceived value of their brand, and increase the number of conversions and sales as a result of using an A.R. solution. After the encounter, customers voted the firm more than simply a skincare brand in their polls.

Facebook’s Spark AR studio has also embraced the interactive experience’s increase in popularity. Consumers may virtually try on cosmetics without ever leaving the Facebook, Instagram, or YouTube apps, thanks to the integration of this technology into their banner ads. With the advent of virtual reality (V.R.) try-on services on their websites and smartphone applications, a slew of well-known fashion and beauty companies have followed suit.

6. NATURAL, CLEAN, AND TRANSPARENT BEAUTY

Consumers are increasingly looking for companies that are as open about their ingredients as they are natural. A growing interest in natural cosmetics has been sweeping the market since 2018, yet there are still a lot of unanswered concerns surrounding this hotly debated and sometimes perplexing topic.

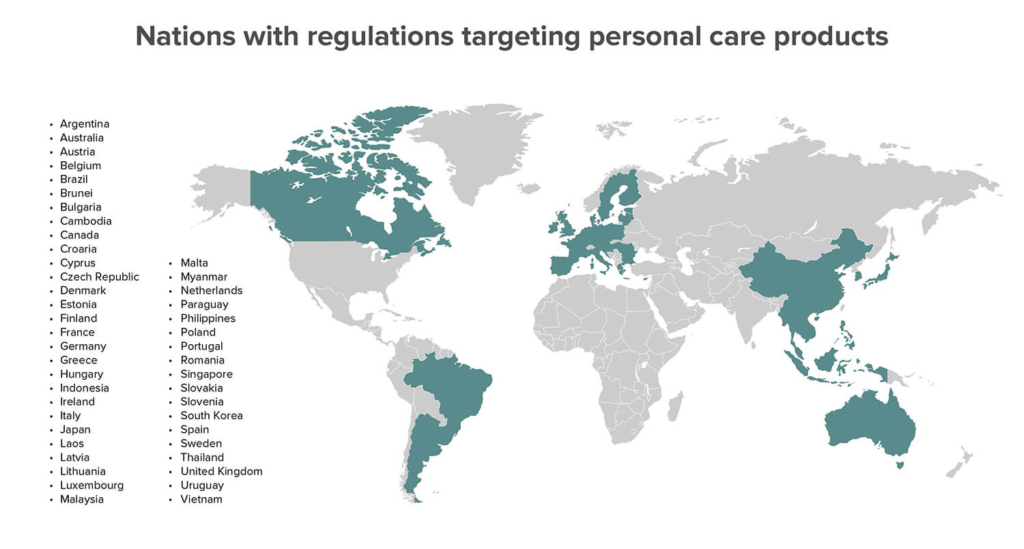

There is much misunderstanding about what’s considered safe and what isn’t by the FDA and E.U., but more businesses are emerging from this with minimalistic and transparent ways as customers keep an eye out for what’s in their products.

Nielsen observed that customers in the cosmetics business are increasingly gravitating toward products that are both more natural and more objectively straightforward. Instead of blindly following corporations’ notions of what constitutes “natural,” customers make their own decisions.

Products that claim to be natural and free of parabens are increasing five times faster than those that fulfill the paraben-free standard. The American cosmetics company Kiehl’s, for example, changed its Ultra Facial Cream to eliminate parabens and saw a $5 million increase in sales. As a result, it now ranks among the top five premium skincare brands in the United States.

(Source: Common Thread)

A Harper’s BAZAAR survey of more than 1,000 women of all ages, races, and ethnicities found that 60 percent of women are keen to invest in new companies that promote natural products. Fifty-five percent of those polled were interested in learning about new sustainable companies.

New niches like blue beauty, which refers to items that safeguard the seas and water resources, are emerging because people are willing to try new things if they are clean.

As a result, new audiences are being tapped. One of the most recognizable names in the makeup industry today, Millie Bobbi Brown’s makeup line Florence by Mills, is known for its commitment to environmental stewardship and aims to reach out to a new generation of socially conscious consumers concerned about global issues such as climate change.

7. LEVERAGING BIG DATA FOR NEW PRODUCT DEVELOPMENT

Ipsy’s co-founder Jennifer Goldfarb at WWD’s Digital Beauty event said big data is the next big concept in the digital beauty space. When it comes to the future of branding, successful brands can attract their consumers, followers, and fans’ attention and bring them into the community. And brands are doing this using big data

Olay, a household brand, reversed its declining trend after years of familiarity and staleness by integrating digital techniques into its workflow and gaining a better grasp of what its customers wanted. The company’s Olay Skin Advisor, a web-based, data-collective application designed to assist consumers in understanding the right products for their skin, was introduced in partnership with Procter & Gamble. The Olay Skin Advisor has gathered more than ten million data points, which have had a substantial influence on product development.

(Source: Olay Skin Advisor)

For example, the brand discovered that a significant portion of customers prefer skin care products that are fragrance-free. So, it released scent-free Olay Whip face moisturizers, which have been “just as popular” as the original. Plus, Olay Retinol 24 is one of the brand’s upcoming products because retinol is the most frequently sought ingredient on the internet.

As Olay North America’s brand director, Eric Gruen, explains, More and more companies in the beauty business are adopting data collecting and analysis, and they’re finding that it outperforms their original expectations.

To assess over 20,000 substances and peer review thousands of particular scientific publications, Proven, a beauty start-up, analyzes data obtained freely from the internet and employs an A.I. engine. It has developed a complete individualized beauty regimen for its customers using its vast database and machine intelligence.

(Source: Proven Skincare)

8. PERSONALIZED EXPERIENCE

For a variety of reasons, personalization is becoming more essential to customers. It helps customers feel like they are getting communications designed precisely for them in a world where we are inundated with marketing messages. Personalization may foster loyalty and connection between a business and its customers as an additional benefit. As of 2020, 56% of online customers said they would return to an online store that offered tailored suggestions, while in a separate SmarterHQ poll, 81% of shoppers said they only purchase with businesses that provide personalized experiences.

Customer loyalty increases when a brand feels like it understands the customer’s needs and wants.

Cosmetics businesses that provide individualized experiences are more likely to build meaningful connections with their clients in 2022 as customization technology advances.

Apps like Clue, which just joined with L’Oreal to provide women personalized hormone-related skincare recommendations, and Toothfairy, a new dental tech app, are also on the popularity rise.

9. BEAUTY SUBSCRIPTION SERVICE

According to research by Royal Mail on the U.K. Subscription Box Market, there will be a subscription box industry of £1.8 billion in Britain alone by 2025. And in the U.S., 25 percent of American customers (including men and women) already get a subscription box, according to First Insight’s poll on subscription boxes, and another 32 percent of respondents expect to do so in the next six months.

In addition, according to Shingetsu Research, women are expected to take over the industry in China by 2027 because of a growing working population, a shift in female purchasing preferences toward convenience, and the growing popularity of subscription boxes for clothes, cosmetics, and hosiery in China.

Now, precedents like Birchbox and Glossybox, a subscription box business model, may be a massive success for beauty e-commerce. Curation services — subscriptions that try to find and surprise customers with new things or highly tailored experiences – got 55% of all subscriptions and were by far the most popular, indicating a significant need for individualized services, according to a McKinsey survey of 5,000 US consumers.

It’s no surprise that companies like P&G (Gillette on Demand), Sephora (Play!), and Walmart are interested in supplying beauty subscription boxes and men’s grooming services since these segments have been recognized as having the most significant development potential (Beauty Box).

In addition to meeting the demands of its members, beauty boxes also provide the opportunity to discover new goods. Consumers (especially curation subscribers) anticipated subscriptions to grow more quickly. They desired something fresh and unique to continue paying.

Subscription services such as FabFitFun are a good example. Beauty, health, and home design products appear in the monthly box. The brand has risen 300 percent year-over-year, with annual sales of $200 million. The FabFitFun discussion board on the company’s website, where members can debate recipes, weight reduction, and decorating advice, is a great way to keep subscribers interested in the brand in between delivery. Additionally, they have recently started a daily Facebook Live broadcast where viewers can learn about new goods and other aspects of the company’s lifestyle.

As the popularity of subscription boxes grows, more companies will turn to social media and content marketing to foster a feeling of brand community.

ENDNOTE

What’s ahead for beauty eCommerce?

A lot can be learned from how beauty firms have done this in the past when creating strong personal connections with their consumers.

See how we have helped prominent beauty firms with our top-notch supply chain capability so they can be ahead of the curve and serve their customer’s well-facing change Ecommerce consumer trends.